Forex Brokers: Newest Updates and Market Insights

Forex Brokers: Newest Updates and Market Insights

Blog Article

Deciphering the Globe of Foreign Exchange Trading: Uncovering the Significance of Brokers in Managing Dangers and Making Certain Success

In the elaborate realm of foreign exchange trading, the role of brokers stands as a critical aspect that usually stays shrouded in secret to several aspiring investors. The complex dancing in between investors and brokers unveils a symbiotic partnership that holds the key to untangling the enigmas of lucrative trading endeavors.

The Duty of Brokers in Forex Trading

Brokers play an essential role in forex trading by offering vital services that help traders manage threats efficiently. One of the key functions of brokers is to give traders with access to the market by helping with the execution of trades.

Moreover, brokers offer leverage, which makes it possible for traders to regulate bigger positions with a smaller sized quantity of funding. While take advantage of can magnify earnings, it additionally increases the potential for losses, making risk administration important in foreign exchange trading. Brokers supply risk monitoring tools such as stop-loss orders and restriction orders, enabling traders to set predefined leave factors to decrease losses and secure profits. In addition, brokers offer academic sources and market evaluation to assist traders make informed decisions and establish reliable trading methods. Generally, brokers are crucial companions for investors looking to browse the foreign exchange market effectively and manage risks properly.

Threat Administration Methods With Brokers

Given the vital role brokers play in facilitating accessibility to the fx market and offering risk monitoring devices, comprehending efficient approaches for taking care of risks with brokers is important for successful forex trading. One key method is establishing stop-loss orders, which allow investors to predetermine the optimum quantity they want to shed on a profession. This tool assists limit prospective losses and shields versus negative market movements. One more vital risk administration method is diversification. By spreading financial investments throughout various money sets and property classes, traders can reduce their exposure to any type of solitary market or instrument. Furthermore, using leverage cautiously is important for danger administration. While leverage intensifies revenues, it likewise multiplies losses, so it is vital to make use of take advantage of deliberately and have a clear understanding of its effects. Last but not least, preserving a trading journal to track efficiency, examine past trades, and recognize patterns can assist investors fine-tune their techniques and make more enlightened decisions, inevitably improving risk monitoring techniques in foreign exchange trading.

Broker Option for Trading Success

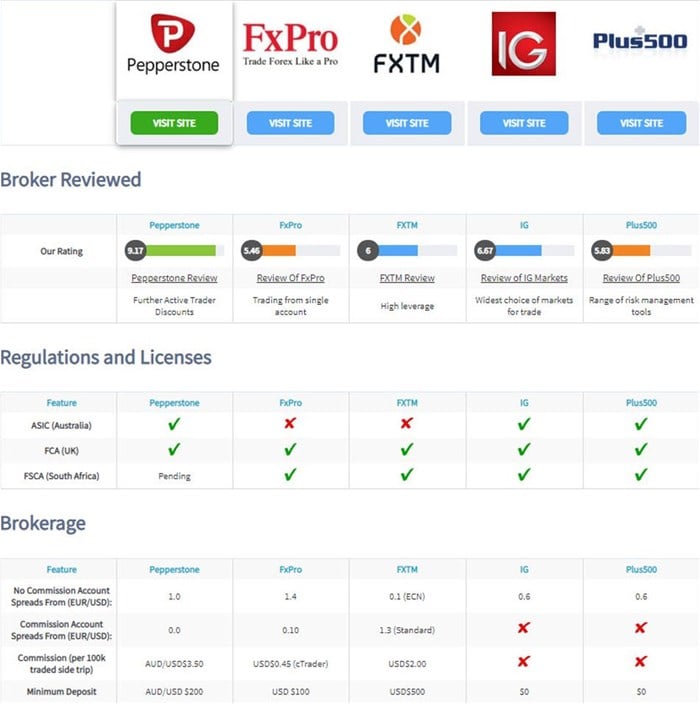

Choosing the ideal broker is critical for achieving success in forex trading, as it can dramatically impact the total trading experience and results. Working with a controlled broker provides a layer of safety for traders, as it makes certain that the broker operates within set guidelines and requirements, thus reducing the risk of fraudulence or negligence.

In addition, investors must analyze the broker's trading system and devices. An user-friendly platform with sophisticated charting tools, fast profession implementation, and a variety of order kinds can boost trading efficiency. Examining the broker's client assistance solutions is important. Motivate and reputable consumer assistance can be important, specifically during unpredictable market conditions or technical problems.

In addition, investors ought to examine the broker's charge framework, consisting of spreads, compensations, and any type of covert charges, to comprehend the expense effects of trading with a specific broker - forex brokers. By meticulously evaluating these elements, traders can choose a broker that lines up with their trading goals and sets the stage for trading success

Leveraging Broker Experience commercial

Exactly how can traders properly harness the know-how of their chosen brokers to take full advantage of profitability in foreign exchange trading? Leveraging broker knowledge for revenue requires a critical method that involves understanding and utilizing the solutions provided by the broker to boost trading results.

Additionally, traders can gain from the support and assistance of this page skilled brokers. Developing an excellent partnership with a broker can cause customized recommendations, profession recommendations, and risk monitoring methods customized to specific trading designs and objectives. By interacting consistently with their brokers and looking for input on trading strategies, traders can take advantage of expert knowledge and boost their overall performance in the foreign exchange market. Ultimately, leveraging broker expertise for profit involves active engagement, continual knowing, and a collective technique to trading that makes best use of the potential for success.

Broker Support in Market Analysis

In addition, brokers can offer prompt updates on economic occasions, geopolitical developments, and various other elements that might impact money prices, enabling investors to remain ahead of market variations and adjust their trading placements as necessary. Ultimately, by making use of broker assistance in market analysis, investors can improve their trading performance and boost their chances of success in the competitive foreign exchange market.

Conclusion

In conclusion, brokers play a critical function in forex trading by handling dangers, offering knowledge, and aiding in market analysis. Picking the best broker is essential for trading success and leveraging their expertise can bring about profit. forex brokers. By making use of risk monitoring methods and working closely with brokers, traders can navigate the complex globe of forex trading with self-confidence and enhance their chances of success

Offered the critical role brokers play in facilitating access to the international exchange market and providing danger monitoring devices, comprehending reliable strategies for handling dangers with brokers is essential for successful foreign exchange trading.Selecting the ideal broker is vital for attaining success in foreign exchange trading, as it can considerably affect the total trading experience and outcomes. Working with a regulated broker offers a layer of protection for traders, as it ensures that the broker operates within set standards and guidelines, therefore reducing the risk of fraud or malpractice.

Leveraging broker expertise for profit calls for a strategic method that entails understanding and making use of the solutions supplied by the broker to improve trading results.To her comment is here successfully utilize on broker expertise for earnings in foreign exchange trading, traders can count on broker aid in market evaluation for notified decision-making and danger mitigation strategies.

Report this page